Charting The Performance of Stocks on a Google Sheet

When looking for stock investments, I often want to know how one stock has performed in comparison to another. Sometimes that comparison will be to an index, like the Dow Jones Industrials (.DJIA) or sometimes to a competitor company or sometimes just two staple companies in two different industries to see how the industry performance compares.

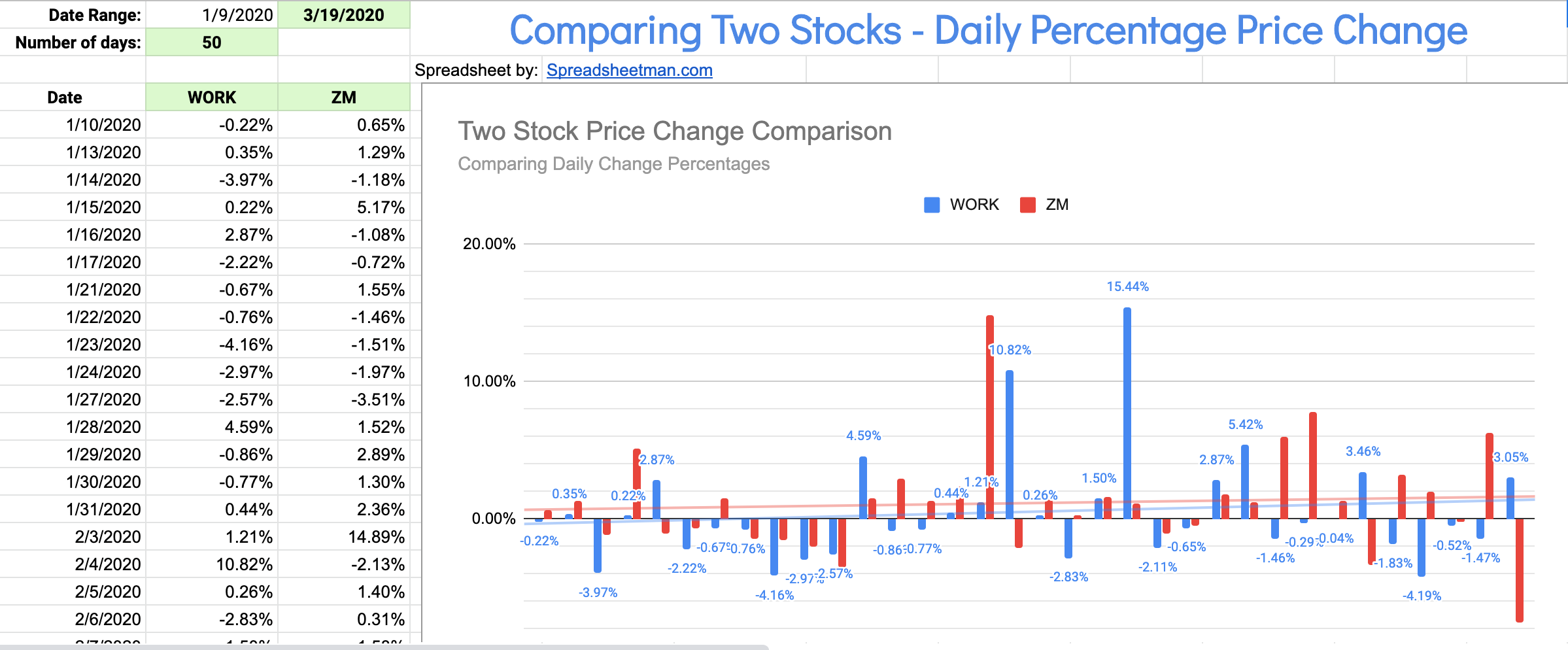

Example of a comparison: Slack (WORK) vs Zoom (ZM)

The main data you need to do this is historical price quotes - usually closing prices being enough to do the job. Google Sheets allows you to get historical data in a spreadsheet as I described in an earlier blog post. It also allows you to chart that data quite easily.

In these crazy times of COVID19 - and related crazy investment markets, I found myself wanting to do these comparisons more and more - and I also found lots of other people who wanted the same…. so, of course - I created a spreadsheet to share that does this quite easily.

The spreadsheet needs only 4 inputs - The two tickers of the stocks you want to compare, the END date of the comparison, and the number of days you want in history (up to 50). The start date is calculated backwards for you skipping weekends.

You can request access to this spreadsheet to get your own copy and do your own comparisons!

Should I invest in stocks or pay down my mortgage?

If you’re a conservative investor, I’m sure you’ve had people try to convince you that “you should invest in stocks!” because, it’s true that, historically, stocks out-perform other types of investments.

Of course, that’s not the point to the conservative investor. The point is safety, peace of mind and capital preservation. There have been enough down-turns in the stock market, that it’s practical to be concerned about losing money if you might not have the time to wait out a down market. So, then what should you invest in?

Another similar situation is when you suddenly have money to invest - say from a tax refund or inheritance or… lottery winning… yeah, lots of people win the lottery :-/ . Again, you’ll hear from stock investors that “you should” invest in stocks… (I always say what my dad used to say: “Don’t should on me!” ;-)

But there’s another option that might be staring you in the face - and wallet - your mortgage (or perhaps another type of loan - home equity or auto loan)! Maybe paying off that loan is a better “investment” than buying stocks, or bonds, or bitcoin (what!!)? Interest you pay on a loan or mortgage is someone else’s gain, and your loss - and if you pay down the principal, you can pay less interest over time. That’s virtually the same as earning money on an investment.

I decided to do a comparison calculation - in a spreadsheet of course - to compare some scenarios of buying a stock as an investment versus paying down my mortgage.

So here was my approach:

Pick a stock - or an index (like the Dow Jones Industrial Index, or S&P 500)

Pick a date on which I would have hypothetically bought the stock in the past.

Calculate the total invested by multiplying some hypothetical number of shares by the stock price on that date (and work backwards if I have to based on how much I have to invest).

Pick a hypothetical SALE date - and calculate the gain or loss on that hypothetical investment in the stock.

Now take that amount of hypothetical dollars invested in stocks - and calculate what would happen in my mortgage if I paid down my mortgage by that same amount on that same investment date.

Entering the loan terms in the Mortgage Amortization Paydown spreadsheet gives me a basis for calculating interest saved on the paydown investment.

I already have a really useful spreadsheet calculator that tells me how much interest I can save by paying more toward my mortgage at any given payment period, so plug in my mortgage terms, and enter the total invested amount into the Additional Payment cell at the date I made the stock investment (hypothetical, of course).

Grab the total interest SAVED amount that was calculated in that sheet and compare it to the total return I got on the stock.

WHAM! Now I have a clear comparison! It’s not exactly correct - as the interest saved amount is over the whole life of the loan, but I could eventually just add some time value of money on the stock investment - or use my crystal ball to see where that stock will be on the same end date :-| - but this is close enough…

Here’s two scenario comparisons…

STOCK PURCHASE: Assume I bought 100 shares of Google (Alphabet) on 1/2/2015 - the price was $523.37 - so my total invested was $52,337.00 (whoa… hypothetical).

Let’s also assume I sold it on 3/12/2020 for 1,114.91 per share - for a total value of $111,491.00 - that’s a GAIN of $59,154 !! wow!

MORTGAGE PAYDOWN: So let’s assume I took that initial investment of $52,337.00 and instead paid down my mortgage on my Jan 2, 2015 payment.

That paydown in 2015 on my $250,000 mortgage (also hypothetical, BTW) would have resulted in a total interest saving of $66,691.59 !!! THAT’S MORE THAN THE STOCK GAIN - by $7,537.59 !!

In this scenario, the mortgage paydown results in a bigger “gain” (savings of interest over the life of the loan). The unfair part of this comparison is that the mortgage savings is over the life of the loan - which is shortened by the paydown, but the stock gain funds would be available again on the sale date - which is much sooner.

Now - just to put an exclamation point on the stock market variability - which of course this past week began to go extreme - If I sold that same stock ONE day later on Mar 13, 2020 (Friday the 13th) - the price would have been $1,219.73, the gain would have been $69,636 - and so the Stock investment would have exceeded the mortgage paydown option by $2,944.41 !! So - in stocks - timing is everything - and there is no crystal ball.

This is the March 13th example where stock investing “wins” by a slight margin.

I hope this helps to expose some new ideas on the options many of us have when it comes to investing available funds - but of course - there’s never a one-size-fits-all answer, so do your own analysis or, better yet, work with a professional, which I am not! ;-)

This post was inspired by a tweet from @LizOfficer on Twitter on this very subject :)

Should You Refinance Your Mortgage? Calculate your answer…

You hear “Mortgage Rates are the lowest they’ve been in decades” but - does that mean everyone should refinance? Is NOW the right time? Will rates go lower?

Let’s face it - the only question you can reasonably answer is whether refinancing NOW will actually save you money. You can’t predict the future - if you could, you wouldn’t need a mortgage ;). The best thing you could do is focus on those things you can control.

When it was time for me to consider refinancing, I did what any good spreadsheet geek would do - I poured a glass of wine. Oh, and then I created a spreadsheet!

I created this mortage refinance analysis calculator to match the process I used in answering the question “Will I actually save money after closing costs, and what is the payback period?”.

First, you have to enter the terms of your current mortgage to have a basis of comparison to the new options available.

This is a simple step and the monthly payment calculation should reflect what you’re paying today.

Of course the next step is collecting new mortgage options. There are loads of ways to do this - either online or through your current bank or simply contacting other banks directly to see what they’re offering. The methods you use online should take into consideration how much spam (er… advertising and promotion) you want to receive after your initial request. Using sites like Lendingtree.com or Nerdwallet.com or Bankrate.com, you can get good initial information, but will likely need to give more contact information to get deeper data like closing costs. Remember - most of those sites get fees from actual lenders - banks - when they feed your information to them and you end up closing on a loan - so they are by nature trying to get you to click through to the bank sites - or - collect your information. The Banks also will want your contact information to sell you a loan. “More contact information” means you’ve got the risk of being bombarded with call-backs or emails - so consider that before giving out contact information. Mortgage companies are very competitive in trying to reach you early and often.

Doing simple searches will give you a good sense whether your rate is way higher than the rates being offered today, and even the Google Search “refinance mortgage rates” will give you the fast look from Bankrate or others.

Once you have some options - and some data - about refinance mortgage terms you can potentially obtain, you can use the mortgage refinance analysis calculator spreadsheet to compare those to your current mortgage. The calculator gives you your new payment amount for up to three loans, as well as your closing costs of the points you’ll likely have to pay at close. Make sure you get that data from any potential loan provider as well as OTHER CLOSING COSTS. Always ask those questions so you can compare fairly the options against your current loan.

Once you have your current loan and the new loan options in the spreadsheet, you get a picture of the monthly savings (assuming the new loans result in a lower payment than your current loan) and a calculation of the number of months payback period to cover the closing costs you paid to refinance. That is where you’ll get a sense of whether it’s worth refinancing. If it takes 24 months to pay yourself back the cost of closing, it might not be worthwhile - but if the payback period is just 3 or 5 months, it seems like a no-brainer. The calculator will also tell you how much you’ll save PER YEAR with the reduced monthly payment.

This is where the decision is made… are you going to save enough money every year and will you be able to make up the closing costs in a short period of time?

The calculator also allows you to enter adjusted terms for your existing loan - in case your bank offers you new rates knowing that you might refinance. This happened to me - since they knew I was way over-paying at the time.

Try the Mortgage Refinance Analysis Calculator if you’re thinking of refinancing and need a simple way to help make the decision!

How a Spreadsheet can help you manage travel or events

Most people hear “Spreadsheet” and think “why would I use a spreadsheet? I’m not an accountant or financial analyst!”. But, as many of us know, spreadsheets are definitely NOT just for numbers. Microsoft Excel, Google Sheets, and newer tools like Airtable, SmartSheets, and many more, are used by people in all industries and jobs - and yes, even at home ;) to manage information and organize aspects of their work or life.

Spreadsheets help manage information - any information - but particularly tabular information. Anything that can be organized in rows and columns can find a happy home in a spreadsheet! Perhaps more interesting, is solving the “collaboration” problem - and online spreadsheets, particularly on Google Sheets, provide a simple way to work with many people to collect, enter and manage information (more on that in a moment).

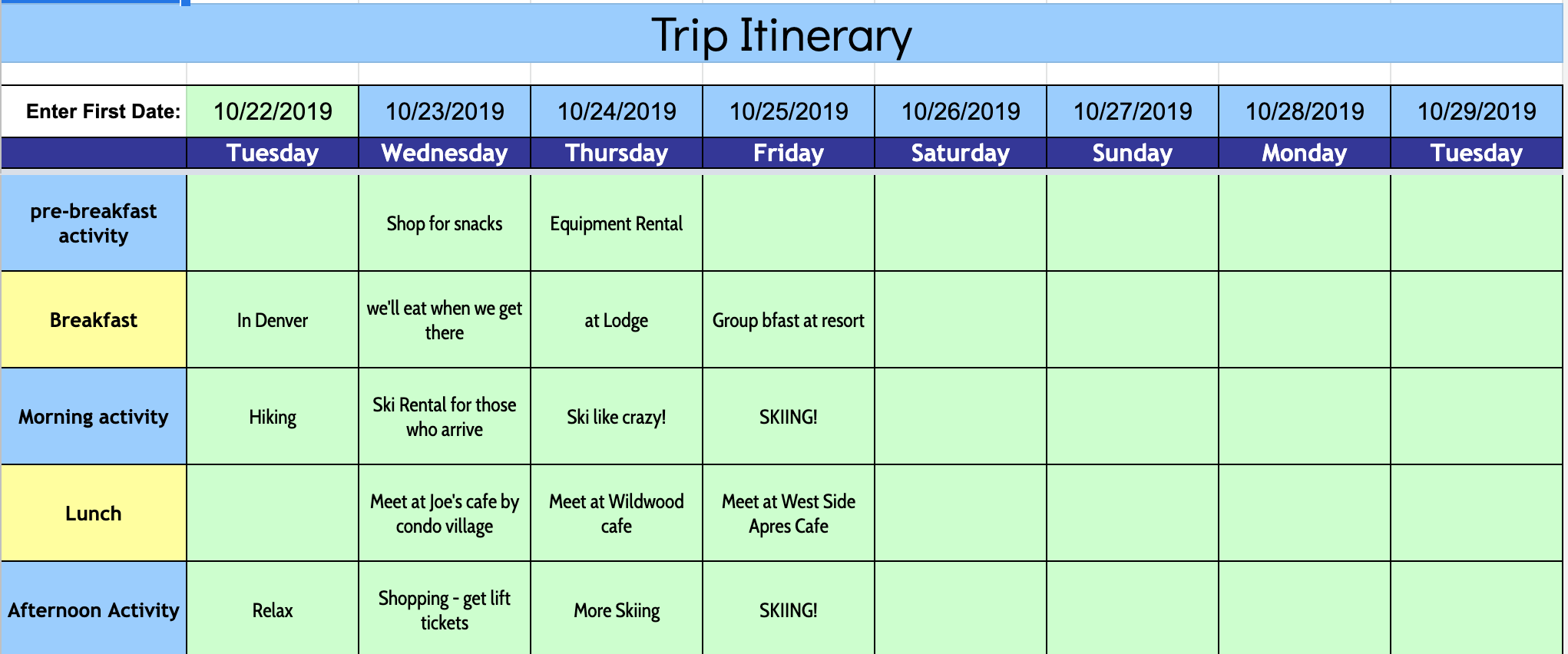

A Tabular Layout is a perfect way to manage the complex organization of a multi-day event…

One of the problems we’ve often solved using a spreadsheet is the organization of an event, or trip. The itinerary of a trip can start out simple, and quickly become more complicated, as new activities are added, or as start times or dates change. A spreadsheet can be used to create a more custom organized view and canvas for managing the trip or event. Even more beneficial is the collaborative aspects of this solution when multiple people are trying to fill in the details during the planning stages. Google Sheets is an online collaborative spreadsheet app which lets multiple people edit at the same time - so planning collaboratively is a snap and you never have to worry about having separate versions of the itinerary or plan that need to be merged - everyone is working on the same single version!

We created the Travel & Event Itinerary Planner to help people plan and organize trips, events or any scheduled activity - over a series of days - or even on a single day.

One of the benefits of the spreadsheet solution for this problem of coordinated planning of an event, is the tabular model. It is very simple in a spreadsheet to set up time-slots - or activity slots - and then across multiple days, just fill in the blanks! The natural product of that method is a simple matrix that people can use to get a quick view of ALL the activities across the multiple days.

The down-side of that matrix or tabular view is that it is packed with information - when sometimes it’s just simpler to look at the current day’s activities in one page without all the other days - or empty slots - getting in the way. The Travel & Event Itinerary Planner spreadsheet solves this by using some cool spreadsheet formulas to re-format and re-display the information entered in the matrix view, into another separate page (sheet, in this case) which summarizes each day in an agenda view which is much easier to read!

The Agenda View makes it easy to see all the activities, day by day, rather than the tabular view.

The next time you’re planning an event, or a trip - whether for family and friends or for work - try the Travel & Event Itinerary Planner spreadsheet! If you’ve never used a collaborative spreadsheet online, this is your perfect opportunity to see the magic of collaborative planning and sharing!

Instant Blog Post Index in a Google Sheets Spreadsheet

Did you ever wish you could easily have a list of blog post titles with links in a spreadsheet so you could easily see them all in one place, or maybe add some data related to each? What data, you ask? Maybe promotion text for tweets or counts of promotion posts, or just tracking categories or other data that might help you manage your content…

I have… So I did ;)

I created a quick spreadsheet that make it easy using Google Sheets and the simple function that imports the blog RSS feed with one simple formula.

The spreadsheet - which you can see here and get your own copy (use the File / Make a Copy menu) …

… has a simple formula that you don’t even have to change yourself - you can just enter the new blog RSS feed URL on the sheet and the formula will use that!

The IMPORTFEED() function does have a limit of grabbing just 250 posts - but it’s still pretty powerful! Some feeds it seems actually limit to 100 posts - but you can experiment to see how it goes.

I tried it with one of my favorite blogs - JMoney’s BudgetsAreSexy.com blog - which gives you a quick way to check out the titles of all his recent posts - and even a quick way to link to all those posts!

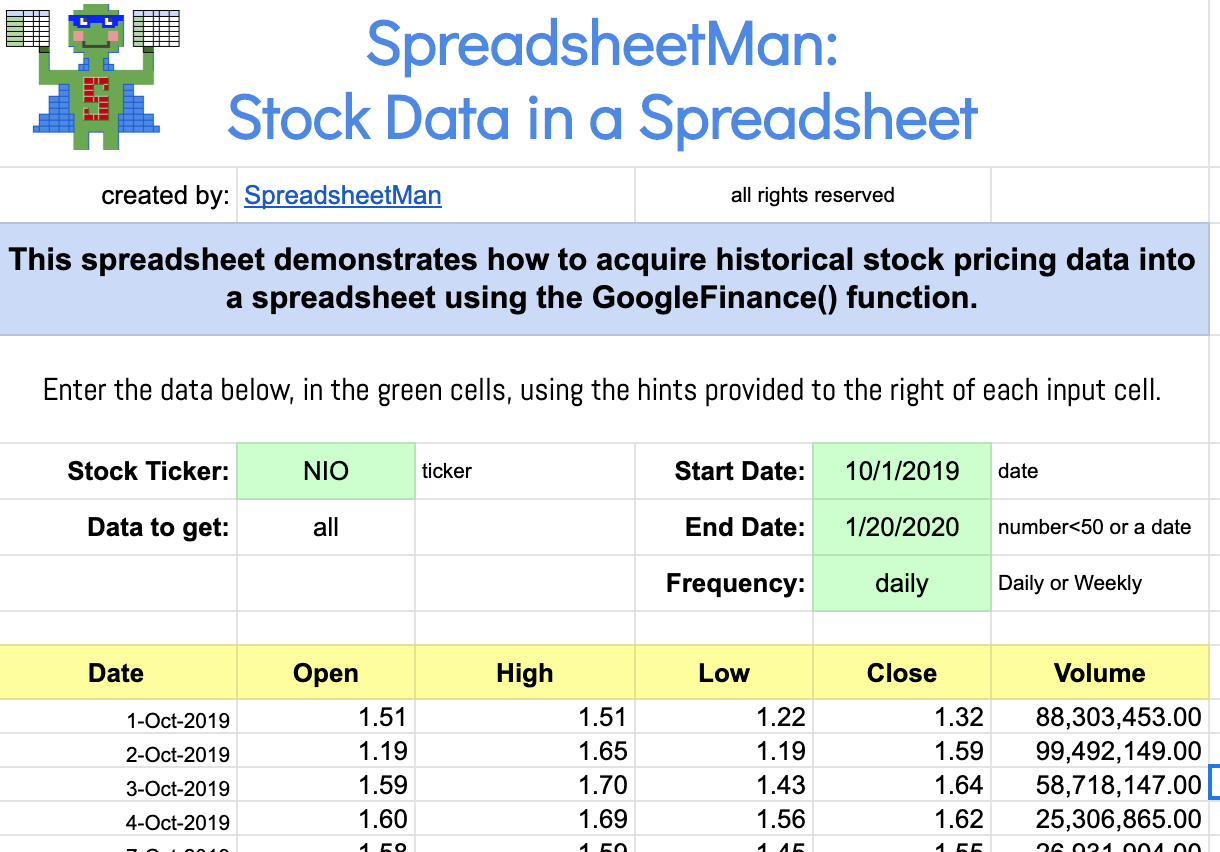

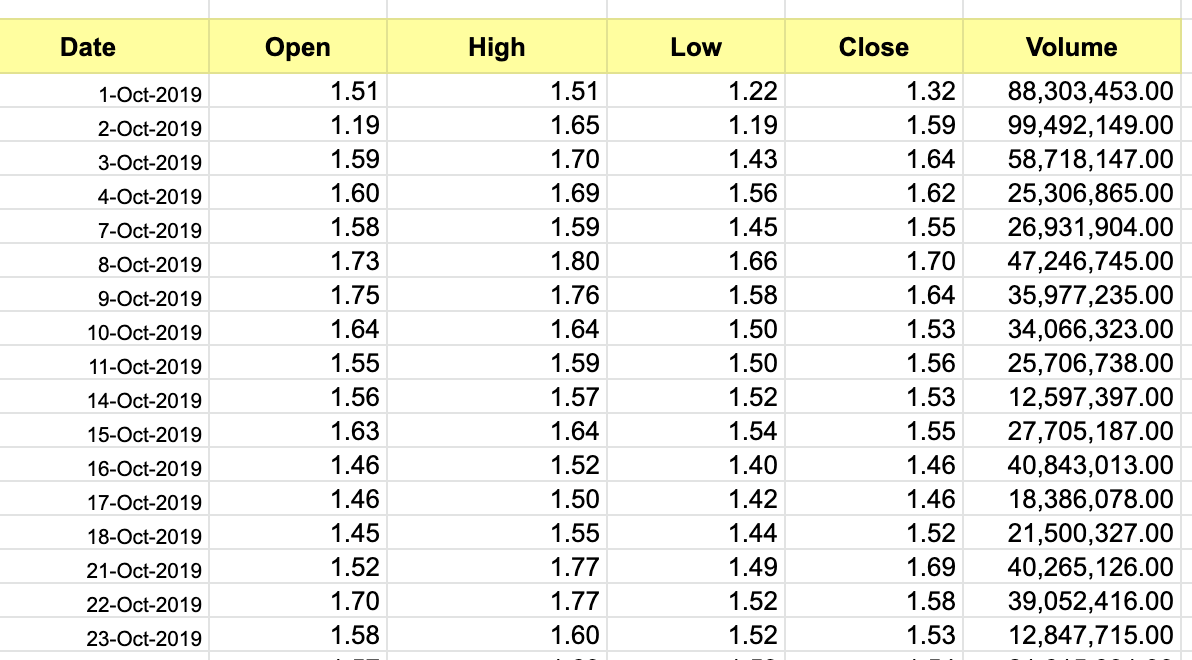

Using Historic Stock Price Data in a Google Sheet

There are many great ways to analyze investments - particularly public company stocks - using the internet today. Yahoo Finance and Google Finance being the most easily found and used - but also MarketWatch, MSN and practically every broker and mutual fund site like Schwab and Fidelity when you have an account there - all provide loads of data, news and analysis.

Sometimes, those internet sources still don’t provide exactly what I want - which is often just a simple spreadsheet of historic price data on a particular stock.

A spreadsheet gives me flexibility to analyze the data, chart it, add hypothetical trades (yes, fake trades so I don’t actually lose money ;) and use it in other contexts by simply copying and pasting.

While some of the internet tools give me the ability to “export” stock data into a spreadsheet format (CSV or XLSX), that creates more work - saving the data, importing it into a spreadsheet, getting the formats right. I like to use a more direct method of getting the data into a spreadsheet, a Google Sheet in particular - and that is the GOOGLEFINANCE() Function. Even if you’re not a Spreadsheet superhero yet, and perhaps not comfortable yet with spreadsheet formulas, you can easily learn to use the Google Finance function - especially using the simple instructions in this post and the Google Sheet template I provide.

The Google Finance Function

Most Spreadsheet formulas use data from within the spreadsheet you are working in - and sometimes take data from other spreadsheets. The Google Finance function is unique in that it obtains data from a completely separate source of historic stock price data. But like any formula, it will require some inputs that you must provide. When using any spreadsheet formula, it’s important to understand those inputs, which gives you an idea of the options you have when you use the formula. The other special characteristic of this Google Finance function is that it will return data into more than the one cell where the formula is entered. It will return a whole table of data - one or more rows, one or more columns - in many cases. It will warn you if that returned data would have overwritten other data in your sheet.

The Google Finance function inputs are described in full in the Google Sheets help page. I’ll explain here the set of options that provides a simple history of stock price and other data - and won’t cover the many more options when requesting simply current data on a stock. If you are knowledgable about stock investing, I suggest you look more at that help page to see the extensive set of data you can get for current data when only retrieving one data attribute at a time. You can also use my other stock tracker spreadsheet template to go deeper on using current AND historic data in a format which lets you analyze the performance of hypothetical buy trades.

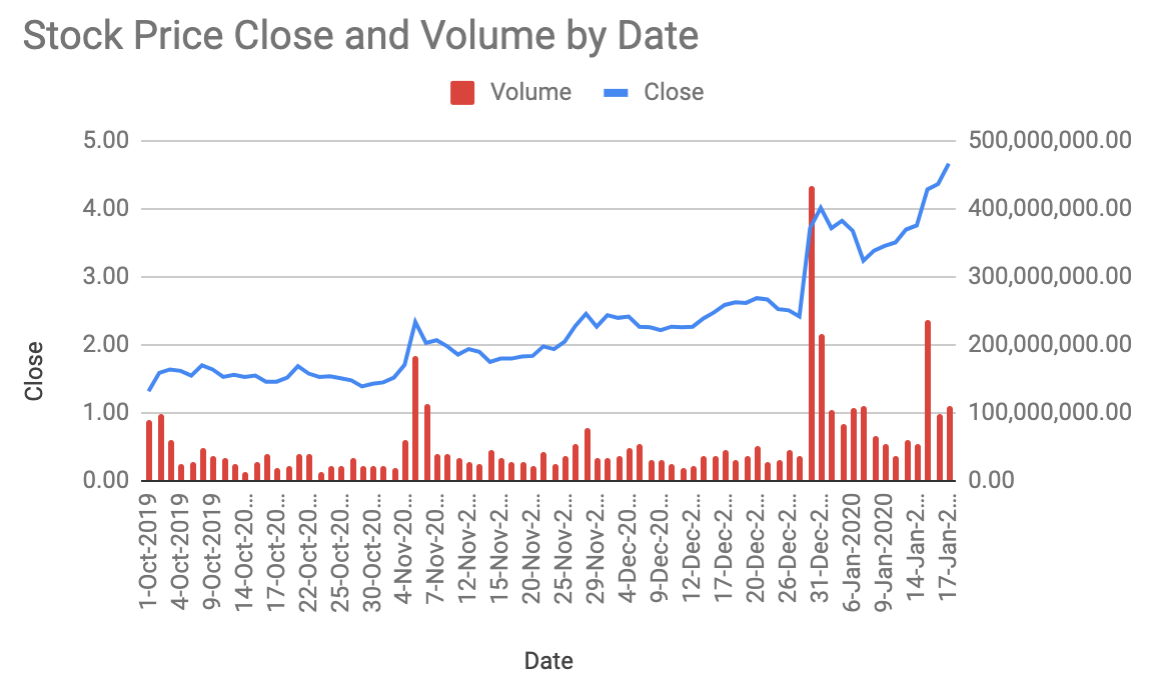

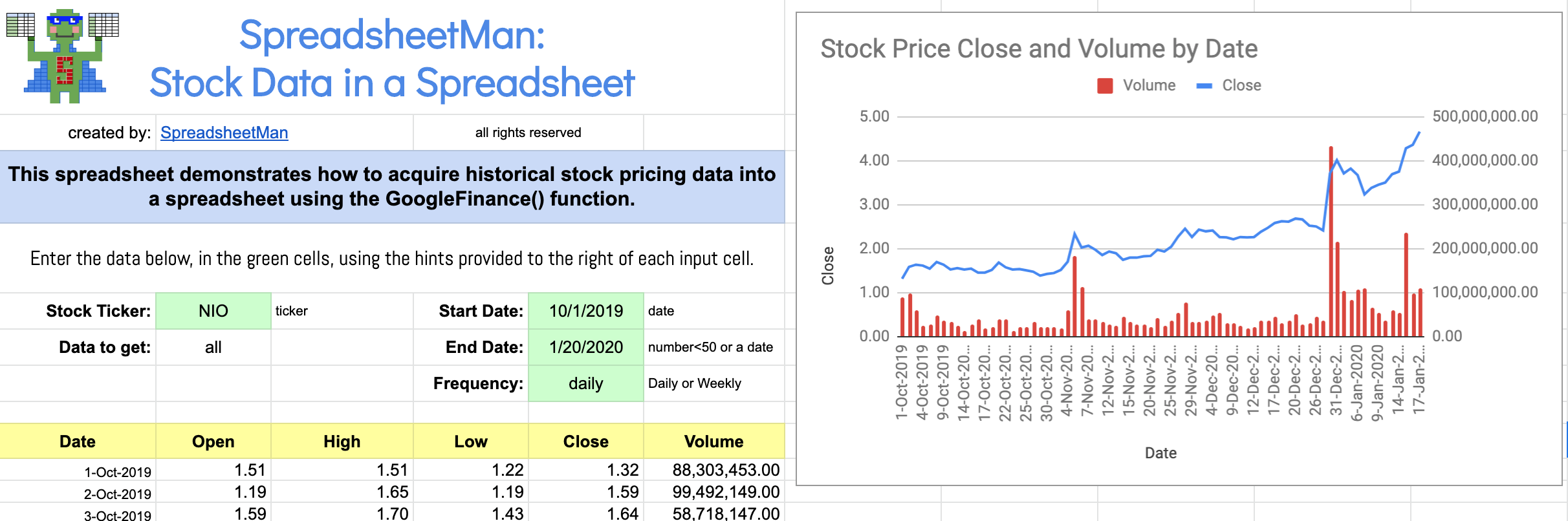

Once you have historical data, it’s also easy to chart it in a spreadsheet…

Getting Started

The format of the Google Finance function, used in a cell formula, is simply

=GoogleFinance(ticker, *attribute, *start-date, *end-date, *interval)

The asterisked inputs are optional, but we’ll focus on those, since that’s how you get historical price data. BTW, When you start the contents of any spreadsheet cell with an “=”, the sheet expects a formula.

ticker: This is the stock ticker of the stock you are seeking data about - and is the only REQUIRED input. If you only give ticker and nothing else, you’ll get back CURRENT price and volume data. Examples are TSLA for Tesla, GOOG for Google, F for Ford, Inc.

attribute: This is a choice of a specific data point, such as “OPEN”, “CLOSE”, “HIGH”, or more - or using the word “ALL” will return a whole set of date, open, high, low, close and volume (see help page for all options of specific attributes you can request - which is much larger when only requesting current data and not historic).

start-date: This is the beginning date of the historic data you are requesting.

end-date: This is the end date of the period for which you are requesting historic data.

interval: This gives you the ability to request either “daily” or “weekly” data (using those words, or the numbers 1 or 7 also work).

That’s pretty simple. Let’s look at one simple example:

=googlefinance( "tsla" , "all" , "1/1/2020" , "1/30/2020" , "daily" )

That example will return a table of data - 17 rows by 6 columns - of data for the stock of Tesla, Inc. The 17 rows represent one row for each BUSINESS DAY when the stock was traded during the period of Jan 1 through Jan 30, 2020 - and one row at the top with column headers. The 6 columns represent the data - date, open, high, low, close and volume.

Typing in that formula is not hard - but it’s not something you want to do every time you want data. The easier way to use formulas like this is to put the inputs to the formula in other cells, so you can easily change those inputs without changing the actual formula. So, in the sample spreadsheet I will provide you, my formula looks more like this:

=googlefinance( B5 , B6 , E5 , E6 , E7)

Those “CELL REFERENCES” above - like B5 - refers to the cells where the inputs will be in the spreadsheet. This method lets us change the value in B5, for example, to change the stock for which the data will be returned - or E7 to change whether the data returned is Daily or Weekly.

Google Sheets Template Using the Google Finance Funtion

Below is a screen shot image of the sample spreadsheet - and below that a link where you can request access so you can get your own copy.

Here is a link to get access to the free version of this Google spreadsheet!

If you have any questions or follow up posts you’d like to see, use the contact page link below!

Paying off Credit Card Debt is better than any investment.

Money or Interest you earn on savings and investments is good. Interest you pay on loans is bad and a drag on your financial health.

That’s the foundation of personal financial wellness - increase money sources, decrease money uses - or at least decrease debt and use your money for things you value, like food, shelter, entertainment and peanut butter ;). When you have debt (borrowed funds), you are paying interest, which basically increases your cost of whatever it is you bought using the funds you borrowed. Credit cards are notoriously the worst debt (just slightly better than loan sharks) you can carry, as they charge the highest interest rates of most funding sources - and often worse if you have a poor credit rating.

As written in a CreditKarma blog post: “According to the Federal Reserve’s data for the first quarter of 2019, the average APR across all credit card accounts was 15.09% — the highest rate recorded since 1994.”

Now, the “trick” used by credit card companies is to attract people to pay the “minimum payment” - since it appears to be a way to buy more than you can afford with a very minimal (ahem) payment per month. But there is danger here.

Minimum payments do seem attractive - they are usually the lesser of $15 - $35 or 1% - 3% of the outstanding balance. And if you pay that minimum, you can avoid late fees. But, this is the key, you still accumulate interest on the outstanding balance - which basically increases your debt and perhaps keeps increasing your principal amount on which that interest is calculated! You see where that goes? You NEVER escape your ever increasing debt! This is a disaster for financial well-being. It puts you in a perpetual state of paying 15% - 30% or more on an ever increasing balance due. That’s the most expensive loan you’ll ever have.

And that minimum payment is deceptive in another way… When you pay the credit card minimum payment, and won’t have to pay the late fee - you’ll still have to pay the interest due on the outstanding balance - which, if you followed above, is a super high rate against an ever increasing balance!

Now - if you have an extra $500 one month, you might consider your options. You can pay off $500 of credit card debt (or you can buy a venti Starbucks coffee! LOL) or you can put it in your savings account - or invest in a hot stock (‘cause that’s a sure thing ;). But math and history will tell you, paying off a 15%-30% credit card balance wins almost every time as the sure thing smartest option. You WILL save money taking that route.

We use our Credit Card Debt Paydown Calculator to go through some examples below…

Let’s look at one credit card debt situation, with THREE different payment scenarios and the resulting situation of interest paid and financial health:

Imagine having a $5,000 outstanding balance on a credit card with a 16% finance (interest) rate. Let’s unrealistically imagine that you stop buying things on that credit card ;) so the balance is only impacted by your payments and interest due.

SCENARIO 1 (the good? aka not great, but not too bad): You pay $500 per month plus the interest due on the outstanding balance. It will take you 11 months to pay off the credit card balance, and you would have paid only $5,653 over that time - just $653 more than the original amount due. That’s not so bad.

SCENARIO 2 (the bad - and common): You pay $100 a month plus the interest due on the outstanding balance. It will take you 6 years and 9 months to pay off the $5,000 - and you will have paid $11,197 over that time. That’s more than double your original amount due. bummer.

SCENARIO 3 (the UGLY - very ugly): You pay the credit card’s absolute minimum required payment of $35 plus the interest due on the outstanding balance. This is truly ugly, because in this case, you are accumulating additional principal - and not actually paying off your credit card - EVER. In the first 10 years, you’ll have paid $17,528 - with your outstanding balance INCREASING to $14,128 in year 10 - and still growing. This is truly a disaster for anyone’s financial well being - even if you are wealthy. You have paid TRIPLE your original purchase value and still owe another 3 times that value if you pay it now, in year 10 - meaning, overall, you have paid at minimum more than $31,000 to pay off purchases worth $5,000.

There’s loads of scenarios in between these three - but you should strive to be closer to the first two - and never ever approach the third. Paying off your credit card, where rates are typically three times higher than loan rates, is your best bet when thinking of how to spend available money. Take the time to look at and calculate alternative credit card payoff scenarios so you can get yourself out from under that debt burden as quickly as fiscally possible!

New Year, New Giving Strategy: 100% of Profits to Charitable Causes!

Why do I sometimes become SpreadsheetMan?

As I pondered this question - at the end of 2019 and as the new year began - I realized that my motivation was not money. I definitely enjoy the idea that every once in a while I can feel like my next coffee was funded by some brain labor, by one or more of you finding value in something I’ve done. But, that wasn’t the motivation. So - I decided, without hesitation, that I would donate 100% of the profit from this site in 2020 to charitable causes that I, or perhaps my customers, find worthy and valuable to people in need. This makes me feel good - and hopefully makes you feel a bit better about buying something that could help you, and now, others.

“I decided, without hesitation, I would donate 100% of the profit from this site in 2020 to charitable causes…”

So - if not money, what is my motivation for becoming SpreadsheetMan in my otherwise “spare time”?

First - I truly love Spreadsheets. There are so many points in my career where Spreadsheets have transformed solutions I’ve created, and in fact, one transformative product that I was involved in where Spreadsheets truly helped millions of people work together more effectively - and it still does today ;) (I’ll save that for another post).

Second - I truly love learning, and one area I feel I need to learn more about is online small business apps, commerce and automation. What better product to bring to market than the spreadsheets I love to create?! I will likely begin sharing more about those other apps and related solutions (somehow related to spreadsheets, most likely) in the near future on this blog and site. For now, I learn something new with every post, every problem, every rote task that is needed to help me run this small…er… tiny… er… teensy-weensy business called SpreadsheetMan.

Thank you to everyone who helps me make this continually better and more useful - and especially to those who buy - and therefore GIVE to worthy causes.

I will post here the results of this strategy - and how our giving campaign works.

Happy New Year!

Spreadsheets for Sports

So many people I talk to think spreadsheets are for accountants, financial people and data wonks (yes, “wonks” is now a term). They don’t think of using a spreadsheet for things that are non-numeric or data-set oriented - perhaps because they’ve never seen it used in any other creative ways. I, on the other hand, think of spreadsheets as a potential tool for practically anything (well, not for shoveling snow or traveling to Paris, although I could use one to track snowfall and another to help plan a trip to Paris ;)

The area where I’ve surprised the most people is perhaps SPORTS… A long time ago, I used spreadsheets to run some office pools (the non-betting legal kind, of course ;) and it not only made it super simple to run the game, but it introduced so many people to a fun use of a practical tool! The Super Bowl office box pool was one specific spreadsheet that we used for many years - even creating a form where people could submit their guesses and pick their box - and a response email which would confirm their entry and let them know as scores were finalized.

https://www.spreadsheetman.com/shop/superbowl-box-pool-spreadsheet

We made the simple version of the office box pool available here - for now only in simple form for you to manually enter participants - but it’s still a useful way to run the game! Give it a try this coming Super Bowl LIV (that’s Roman Numeral for 54 btw)!!

Calculating Mark-up in Google Sheets

Recently, someone asked on Quora “How do I calculate Mark-up in Google Sheets"?”.

I created a simple spreadsheet to provide as an example… First - let’s agree on what “Mark-up” means. The Mark-up is the percentage of the cost to add to the cost of an item to derive the sale price. That means if the cost of an item is $100 and the mark-up percentage is 50% - the mark-up amount is $50 and the sale price is the cost ($100) plus the mark-up amount ($50) giving a total sale price of $150.

The main requirement is that you know the COST of an item to calculate the markup - but you can also imagine some people would want to enter a specific mark-up percentage and have the sheet calculate the Sales Price. So our example sheet lets you calculate the mark-up, or the sale price. Now, you can also calculate the cost - say if you were a buyer and knew the sale price and assumed some mark-up percentage - so we added that to the spreadsheet too.

Saving for College is a Learning Experience

Saving for college is hard - but it’s feasible if you have a plan - and a plan is only possible if you have a tool to help you know how much to save each year to afford the college you hope to attend - or your children hope to attend.

When it was time for me to consider college, it became clear that my parents would help to finance my education. They were committed and unconditionally supportive - but they weren’t prepared. They didn’t plan ahead to save money in a way which matched the real cost of college. That, of course, would have been hard, since the cost of college was - and still is - skyrocketing, but it was more about not having the tools and an understanding about how to plan - how to save - that prevented them from planning to save the right amount of money.

Luckily for me, there were student loans, and reasonable state school tuition. But it still would have helped them to have the right tools to plan ahead. Let’s think about what data would help plan to save for college:

Average cost of college today with tuition inflation expectations

Time until high school graduation (number of years you have to save)

Amount of saving so far

Rate of return on savings and investments

There are probably other factors - but with these simple data points, and then some simple, and some complex calculations, a good plan for saving for college is very possible. Even with a tool to do this planning, it may end up that you can’t actually meet the saving requirement to afford college - but at least you’ll know where you stand, and know what you can afford.

The College Savings calculator helps people understand what they would need to save - annually, from this point forward, until the start of college - to afford that college. This spreadsheet gives you the ability to plan for two people at one time or two scenarios at one time, so you can compare those scenarios.

Don’t find yourself up against a deadline to pay for college - or apply to colleges you can afford - before planning for the expensive pursuit of a college degree. Get all the help you can in this planning by using tools like this College Savings Calculator!