Loan Comparison Calculator and Explainer

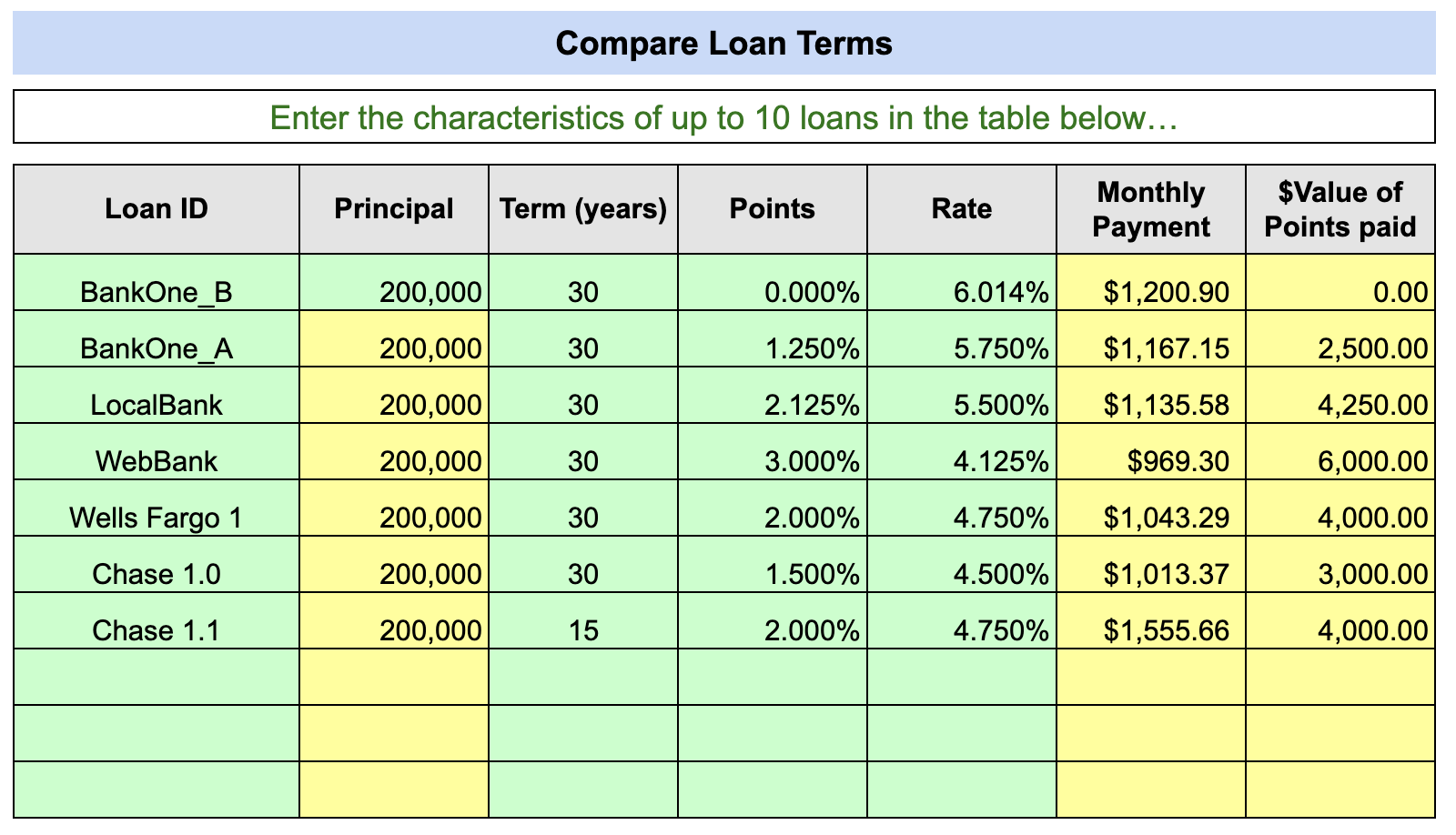

Compare Loan Terms! This spreadsheet lets you list the terms of several loans and then compare two at a time in detail. It provides a high level analysis in numbers of the differences in the loan terms and the resulting payouts over the life of the loans (and monthly, of course).

One unique feature of this calculator is the detailed explanation it provides - in words - about the differences between the two loans. For example, it might tell you “The improved rate in Loan 1 will give you a lower monthly payment, saving you $153.78 each month, $1,845.30 each year and $55,359.03 over the life of the loan.” - now THAT’S an explanation even I can understand!

There is also a graph showing the payout amounts by component, and a detailed yearly schedule for each loan with component totals across points, interest and principal.

Compare Loan Terms! This spreadsheet lets you list the terms of several loans and then compare two at a time in detail. It provides a high level analysis in numbers of the differences in the loan terms and the resulting payouts over the life of the loans (and monthly, of course).

One unique feature of this calculator is the detailed explanation it provides - in words - about the differences between the two loans. For example, it might tell you “The improved rate in Loan 1 will give you a lower monthly payment, saving you $153.78 each month, $1,845.30 each year and $55,359.03 over the life of the loan.” - now THAT’S an explanation even I can understand!

There is also a graph showing the payout amounts by component, and a detailed yearly schedule for each loan with component totals across points, interest and principal.

Compare Loan Terms! This spreadsheet lets you list the terms of several loans and then compare two at a time in detail. It provides a high level analysis in numbers of the differences in the loan terms and the resulting payouts over the life of the loans (and monthly, of course).

One unique feature of this calculator is the detailed explanation it provides - in words - about the differences between the two loans. For example, it might tell you “The improved rate in Loan 1 will give you a lower monthly payment, saving you $153.78 each month, $1,845.30 each year and $55,359.03 over the life of the loan.” - now THAT’S an explanation even I can understand!

There is also a graph showing the payout amounts by component, and a detailed yearly schedule for each loan with component totals across points, interest and principal.