Mortgage Refinance Analysis Calculator

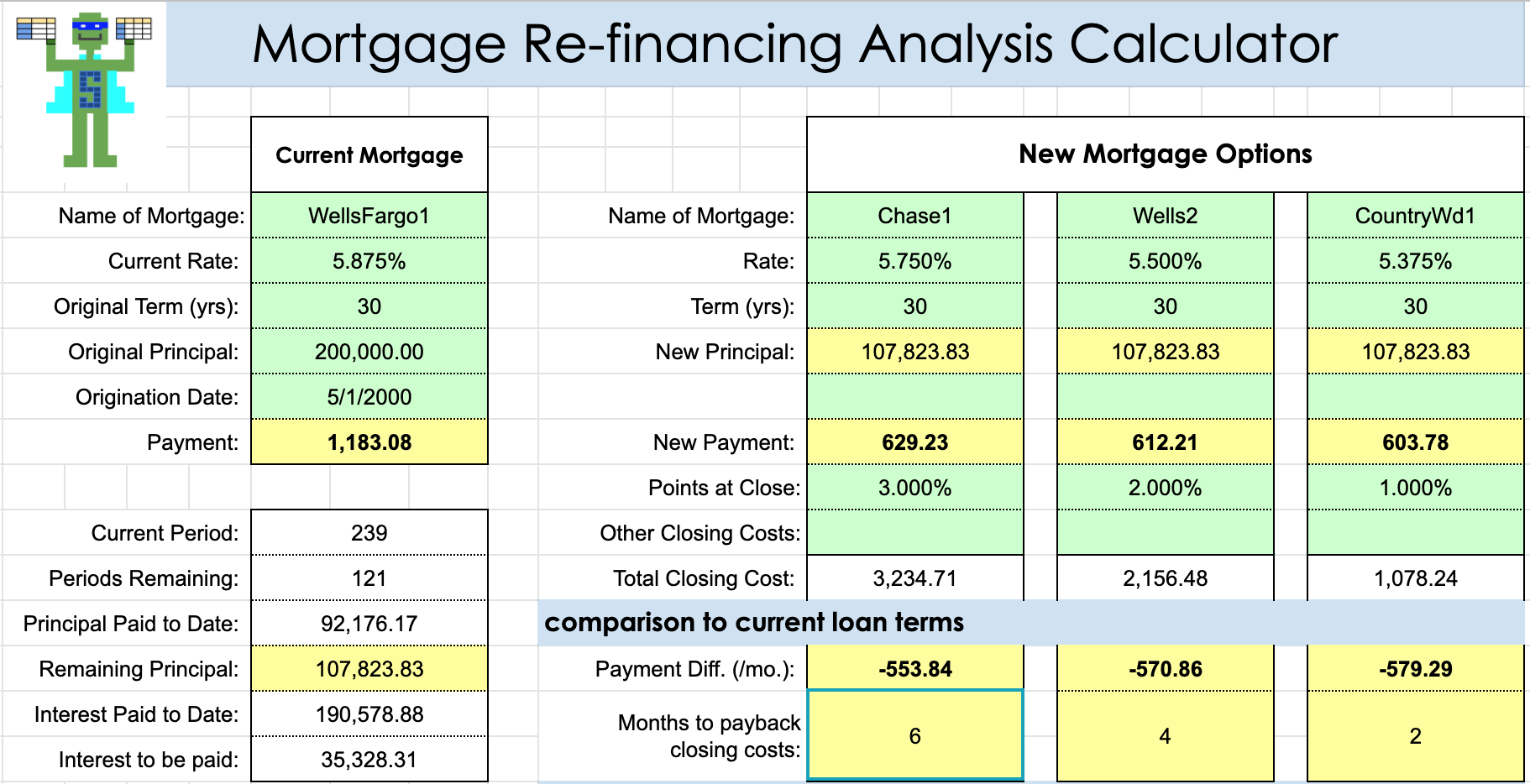

When it’s time to consider re-financing your home mortgage, there are many factors to consider. Even the most basic comparison of terms and calculating your new payment is hard enough, but then add the cost of closing and you quickly realize you want to know “how long before I make up that closing cost with the money I might save every month in mortgage payments?”.

There’s also typically many new loan options you have when re-financing. A shorter loan term - changing from 30 year to 20-year or 15-year, different rates and points paid at closing. Not an easy decision when refinancing.

This spreadsheet calculator helps you compare the impact of new loan terms to your current loan - and to new terms that might be changing on your current variable rate loan. It calculates how much moeny you’ll save each month and the number of months it will take to re-save the closing costs you paid to get that new loan. The calculator lets you enter up to 3 different loans.

You will get immediate access to an Excel XLS version of the spreadsheet upon purchase and you can immediately request the Google Sheets version.

When it’s time to consider re-financing your home mortgage, there are many factors to consider. Even the most basic comparison of terms and calculating your new payment is hard enough, but then add the cost of closing and you quickly realize you want to know “how long before I make up that closing cost with the money I might save every month in mortgage payments?”.

There’s also typically many new loan options you have when re-financing. A shorter loan term - changing from 30 year to 20-year or 15-year, different rates and points paid at closing. Not an easy decision when refinancing.

This spreadsheet calculator helps you compare the impact of new loan terms to your current loan - and to new terms that might be changing on your current variable rate loan. It calculates how much moeny you’ll save each month and the number of months it will take to re-save the closing costs you paid to get that new loan. The calculator lets you enter up to 3 different loans.

You will get immediate access to an Excel XLS version of the spreadsheet upon purchase and you can immediately request the Google Sheets version.

When it’s time to consider re-financing your home mortgage, there are many factors to consider. Even the most basic comparison of terms and calculating your new payment is hard enough, but then add the cost of closing and you quickly realize you want to know “how long before I make up that closing cost with the money I might save every month in mortgage payments?”.

There’s also typically many new loan options you have when re-financing. A shorter loan term - changing from 30 year to 20-year or 15-year, different rates and points paid at closing. Not an easy decision when refinancing.

This spreadsheet calculator helps you compare the impact of new loan terms to your current loan - and to new terms that might be changing on your current variable rate loan. It calculates how much moeny you’ll save each month and the number of months it will take to re-save the closing costs you paid to get that new loan. The calculator lets you enter up to 3 different loans.

You will get immediate access to an Excel XLS version of the spreadsheet upon purchase and you can immediately request the Google Sheets version.